Frequently Asked Questions

In-fund living annuity:

Questions and Answers

In July 2015, National Treasury issued draft regulations on default strategies to be implemented by all funds. The final regulations took effect on 1 September 2017, and from 1 March 2019, all retirement funds had to have an annuity strategy for retiring members to use. The board of trustees of the Stellenbosch University Retirement Fund (‘the Fund’) pre-empted these requirements, having introduced cost-effective in-fund living annuities from 1 January 2017 already. The Fund’s annuity strategy enables you to easily convert all or part of your retirement benefit to a very cost-effective monthly pension from the Fund. This is offered in the form of either a default option or a customised option.

The following questions and answers should provide you with most of the information you require.

What is the difference between the default and customised annuity options?

The design of the default option is based on National Treasury’s regulations. The default option is cost-effective, simple to administer and communicate, and requires very little effort from you, the retired member. It is also designed to be sustainable, ensuring that your capital does not run out during your retirement. The moderate investment strategy manages risk and volatility in investment returns. You can draw a fixed percentage of the retirement capital as a monthly pension. This percentage will automatically change every five years on the anniversary date of your retirement (at ages 65, 70, 75, etc.).

The customised option, on the other hand, offers retiring members more flexibility. You may invest in any combination of the Fund’s investment portfolios (Growth, Capital Protection, Aggressive Absolute Return and Conservative Absolute Return). You may also choose to invest in the Old Mutual Shari’ah portfolio. The customised option allows you to select a withdrawal rate within the limits applicable to your age band. The withdrawal rate is expressed as a percentage, which you may change every year on the anniversary date of your retirement.

May I change from the default to the customised option, and vice versa?

You may switch from the default to the customised option at any time. However, switching from the customised to the default option is only possible on the anniversary of your retirement. This is because your withdrawal rate can only be changed once a year, on your retirement anniversary. The administrators of the Fund must receive your written instruction of a change in withdrawal rate by no later than one month prior to your retirement anniversary.

What investment choices do I have with the default option, and when will they take effect?

If you choose the default option, you do not have to make any specific investment selection. Your pension will be recalculated every year in the month following your retirement anniversary.

What investment choices do I have with the customised option, and when will they take effect?

If you choose the customised option from the outset, or change from the default to the customised option, you have a fair amount of flexibility:

- You may split your investment between the Fund’s Growth, Capital Protection, Aggressive Absolute Return and Conservative Absolute Return portfolios. You may also choose the Old Mutual Shari’ah portfolio.

- You may change your investment instruction as often as you like.

- You may change your withdrawal rate (within the limits set for the customised option) once a year, on the anniversary date of your retirement.

- You may appoint a financial adviser from the Fund’s panel of preferred service providers, or you may appoint your own. The Fund will see to it that the adviser’s fee is deducted and that it does not exceed 0,50% (including VAT) of your assets per annum. However, it is not compulsory to appoint a financial adviser.

- You may choose to stop your participation in the in-fund living annuity at any stage and transfer your remaining retirement capital to another approved retirement instrument (e.g. another living annuity or insurance company).

- You may convert to the default option upon your retirement anniversary.

- If your retirement capital balance reaches a certain minimum level as determined by law, you may apply to have the full remaining balance paid out to you as a lump sum in cash.

How much will I receive as a monthly pension?

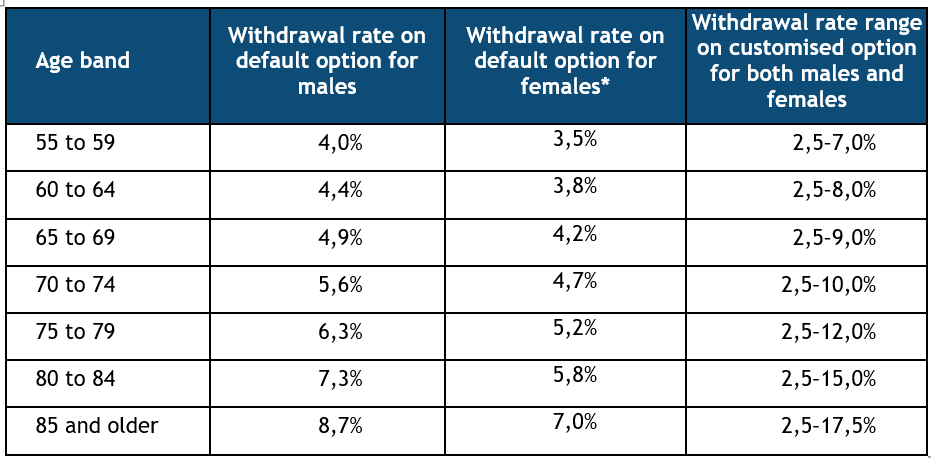

This will depend on the percentage you draw from your retirement capital every month. This percentage is also called the withdrawal rate. The table below sets out the withdrawal rates that apply to each investment option, expressed as a percentage of invested assets.

*The withdrawal rates for females are lower, as females have a longer life expectancy than males.

- On the default option, the percentage is specified and automatically increases every five years (at ages 65, 70, 75, etc.). The new withdrawal rate is implemented on the first day of the month after your retirement anniversary.

- On the customised option, on the other hand, you may choose your own percentage from a range applicable to your age band. You may change your withdrawal rate once a year on the anniversary date of your retirement.

What are the costs if I choose the in-fund living annuity?

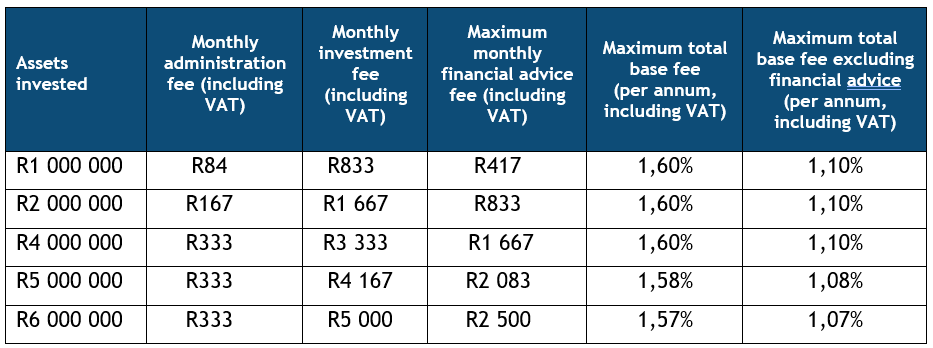

Your fund credit that is transferred to the Fund’s living annuity pool upon your retirement is invested in institutionally rather than individually priced portfolios. This means that the investment management fees will be very favourable, being priced for a Fund and for not an individual member. The investment fee for the default option is approximately 1,00% (including VAT) of your fund credit per annum.

The administration fee is 0,10% (including VAT) of your assets per annum, capped at

an asset value of R4 000 000.

You may obtain financial advice from one of the Fund’s preferred service providers. The maximum advice fee that the Fund will deduct on behalf of the adviser is 0,50% (including VAT) of your assets per annum. If you use your own financial adviser, the advice fee will be deducted from your capital amount.

The table below provides a breakdown of the fee structure for the default option. The total base fee is expressed as a percentage of the assets invested.

As an in-fund annuitant, where is my retirement capital invested?

Under the default option, your capital is invested in a 50/50 mix between an aggressive and a conservative absolute return portfolio with multiple managers. Your monthly income and the operational expenses are paid proportionally from the two portfolios.

Under the customised option, you choose where your retirement capital must be invested, i.e. in any combination of the following portfolios:

- Growth

- Capital Protection

- Aggressive Absolute Return

- Conservative Absolute Return

- Old Mutual Shari’ah portfolio

You also choose from which portfolio your monthly income and operational expenses must be paid. Fact sheets on the above portfolios are available here.

Will I be allowed to change my investment selections and, if so, how often?

Under the default option, you cannot switch between investment options.

Under the customised option, you may invest in any combination of the Fund’s investment portfolios (Growth, Capital Protection, Aggressive Absolute Return and Conservative Absolute Return) or the Old Mutual Shari’ah portfolio. You are also allowed to switch between these six options as often as you require.

Note, though, that a switching fee will be levied from the second investment switch received in a fund year (1 January to 31 December). The switching fee as at March 2023 was R645 (including VAT) and is reviewed every year. The switching fee is paid from your assets held in the Fund.

Will I be allowed to transfer money from other retirement vehicles (such as a private retirement annuity) to my in-fund living annuity?

No, only the retirement benefit originating from the Fund may be transferred to the in-fund living annuity. However, members of the Fund may consolidate money from other approved funds (e.g. a preservation fund) in the Fund before they retire.

On which date will my monthly pension be paid?

Your monthly pension payment will be made on the 25th of every month. To ensure that your first monthly pension amount is paid in time, all the required documents must be sent to the Fund administrators about a month before your retirement date. If not, the first payment will be made in the second month after your retirement.

Will I receive a pension increase every year?

A living annuity pays a percentage of your retirement capital as a monthly pension. The amount remains fixed for 12 months before it is reviewed in line with the withdrawal rate you have chosen and the capital available.

Example:

A male member retires at age 65 with R2 000 000 in retirement capital and chooses to transfer the full amount to the in-fund living annuity pool. The member has chosen the default option withdrawal rate. The retiring member starts by drawing 4,9% of his capital in the first year (R8 166 per month). The withdrawals are funded by the return on the invested capital. If during that year, the investment return is 10%, it means that the retirement capital in the living annuity pool will stand at R2 102 000 at the end of that year. During the next year (i.e. age 66), the monthly pension will be R8 583,17 (i.e. 4,9% of R2 102 000). In essence, therefore, the difference between the withdrawal rate and the investment return earned will be the next year’s increase (in this case 10%−4,9% = 5,1%). Of course, this implies that a negative ‘increase’ is also possible (see next example below).

Also consider inflation. If inflation during the first year was 5%, this means that the increase (of 5,1%) would be equal to 102% of inflation.

Example:

A male member retires at age 65 with R2 000 000 in retirement capital and chooses to transfer the full amount to the in-fund living annuity pool. The member has chosen the default option withdrawal rate. The retiring member starts by drawing 4,9% of his capital in the first year (R8 166 per month). The withdrawals are funded by the return on the invested capital. If during that year, the investment return is 3%, it means the retirement capital in the living annuity pool will stand at R1 962 000 at the end of that year. During the next year (i.e. age 66), the monthly pension will reduce to R8 011,50 (i.e. 4,9% of R1 962 000).

On which date will my monthly pension change?

Under the default option, your pension will change in the month after the anniversary date of your retirement.

Under the customised option, you may change your withdrawal rate on your retirement anniversary. The capital value and your withdrawal rate determine how much you receive per month.

What is the minimum amount that can be invested in the in-fund living annuity?

The minimum amount that can be invested in the in-fund living annuity is R247 500. The trustees review this value from time to time.

Will I pay income tax on the part of my retirement fund capital that I transfer to the living annuity pool of the Fund?

No, the transfer to the in-fund living annuity pool is a tax-free transaction.

Will I pay income tax on the income received from the in-fund living annuity?

Yes, this is a taxable income, similar to any other pension.

How can I be sure that my retirement capital will not run out?

The withdrawal rate under the default option is set at a level that aims to prevent your capital from running out (e.g. 4,9% for males and 4,2% for females at age 65, increasing every five years). More importantly, the capital is invested in a portfolio structure that aims to earn real investment returns.

Although the withdrawal rates of the customised option are also designed to prevent your capital from running out, those opting for this option are exposed to a higher risk.

The trustees are required to monitor the sustainability of all in-fund annuitants’ pensions. If they find that an annuitant may run out of retirement capital, the Fund must communicate this to the affected member.

How do I know that my retirement capital is safe in the Fund?

All investments of the Fund are governed by the Pension Funds Act, particularly regulation 28. As the Fund is a defined-contribution fund, the trustees spend most of their time managing the Fund’s investments to the best of their ability. This includes ongoing communication with members to keep them informed and manage their expectations.

As an in-fund annuitant, what happens when I die?

Upon your death, the value of your remaining retirement capital becomes payable. This payment is governed by section 37C of the Pension Funds Act and involves a formal payment of the benefit to your dependants and/or beneficiaries as agreed to by the board of trustees.

Every year, the Fund will ask you to complete and return a confidential beneficiary nomination form. In this form, you express your wishes on how the benefit must be allocated. Note, however, that the final decision rests with the board of trustees.

Once the trustees have decided how your benefit will be allocated, your spouse may select one or more of the following options:

- Take the amount allocated to him/her as a lump sum (subject to prevailing taxation of lump sum benefits)

- Continue with the in-fund living annuity

- A combination of the two options above

Allocations to other dependants may be paid as a lump sum (also subject to taxation) or utilised to purchase an annuity outside the Fund.

In terms of section 37C of the Pension Funds Act, there must be an investigation to confirm the correct beneficiaries and dependants. A fee may be levied in circumstances where the beneficiaries or dependants are not clearly established by the initial investigation of the Fund’s investigative officer.

May I stop and transfer my living annuity?

Yes, provided that the money is transferred to another approved pension-generating vehicle (e.g. another living annuity or insurance company) and an indemnity is provided to the Fund.

This process is expected to take at least six months, as the transfer needs to be approved by the Registrar of Pension Funds (in accordance with section 14 of the Pension Funds Act). The remaining retirement capital may only be transferred once the Registrar has given approval. While the approval is outstanding, the Fund will continue to pay your monthly pension to you.

Two sets of fees are payable when a member decides to transfer the in-fund living annuity to an external annuity:

- The Fund will levy a fee for drafting a formal transfer application. This fee will be recovered from your remaining retirement capital to be transferred out of the Fund. As at March 2023, the fee was approximately R2 000 (including VAT).

- A fee must be paid to the Financial Sector Conduct Authority for submitting the application to the Registrar. This fee will also be deducted from the amount that will be transferred. As at March 2023, it amounted to R210. The fee is reviewed by the Financial Sector Conduct Authority from time to time.

How do I know how much retirement capital I have left at any stage?

You will be able to track the movement in the value of your retirement capital at any point via the portal at www.retirementfundweb.co.za to determine your fund credit.

Once a year, you will also receive a statement from the Fund administrators, confirming the value of your retirement capital on a particular date.

May I apply for the total value of my investment in the in-fund annuity to be paid in cash?

No, once you have chosen an in-fund living annuity, you cannot opt for a cash payment. The Fund’s rules only allow for a payment in cash once your fund credit drops below a certain amount. This applies to both the default and the customised option. This arrangement is guided by income tax legislation and is referred to as the de minimis rule.

Will I receive a monthly pension statement?

Yes, you will receive a statement confirming your monthly pension, fund-related deductions according to the Fund’s rules, income tax deductions and the like.

Will the Fund deduct my medical aid or any other contributions from my monthly pension?

No deductions will be allowed other than those specified in the Fund’s rules. You will have to arrange with your bank to deduct your medical aid, insurance and other monthly contributions from your banking account via debit order. If you receive post-retirement benefits from Stellenbosch University (e.g. medical aid and group life insurance), these will be deducted via debit order by the University.

When does the option to become an in-fund annuitant expire?

The option to become an in-fund annuitant is available to all members upon retirement. If you defer your retirement and become a phased retiree of the Fund, you may also choose to become an in-fund annuitant when you finally decide to retire.

However, if you have already chosen to take a cash retirement benefit and/or to buy a pension outside the Fund, you will not be able to return to exercise this option at a later stage. The decision to enter the Fund’s living annuity must be part of the benefit payment instruction upon retirement from the Fund.

In short, you can opt out of the in-fund living annuity at any time, but you cannot opt in once you have exited the Fund and your benefits have been paid out.

What communication can I expect from the Fund?

Monthly:

Every month, you will receive a pension statement reporting your gross pension and relevant deductions.

Annually:

Once a year, you will receive:

- a projection statement;

- a drawdown communication to elect your annual drawdown rate (customised option);

- a benefit statement explaining your benefits; and

- a beneficiary nomination form to complete, containing the names of your dependants and beneficiaries and your wish as to how you would like your benefits to be allocated in the event of your death.

From time to time:

You can also expect to receive ad hoc communication about investments.

Do also visit the Fund’s portal and the SURF website regularly to keep informed.

Will I receive any communication concerning the retirement process?

Employees who retire on their normal retirement date (December in the year you reach age 65) will receive a personalized comprehensive electronic report 6 months prior to their normal retirement date.

This report will include important information regarding your retirement process like your retirement fund value, the continuation of employee benefits information, the option to continue with your SUN email address and much more.

This report can be used as a guideline document to ensure a seamless retirement process.

May I appoint a financial adviser to help me with all my options?

While it is not compulsory, you may appoint a financial adviser if you so wish. You have two options:

- You may use a financial adviser from the Fund’s panel of preferred service providers. The advice fee will be limited to 50 basis points (0,50%, including VAT) of your assets per annum. The Fund will deduct the fee from your capital and pay it over to your financial adviser.

- You may appoint your own financial adviser. The Fund will deduct the advice fee, limited to 50 basis points (0,50%, including VAT) of your assets per annum, from your capital and pay it over to your financial adviser.

Transfer of Retirement Fund benefits:

Questions and Answers

The transfer of benefits of members and pensioners of retirement funds to other retirement funds is allowed in certain circumstances, subject to the provisions of the Pension Funds Act and the Income Tax Act.

Transfers before retirement

(In an occupational retirement fund, the period before a member retires from employment. In a preservation fund or retirement annuity fund, the period before the age of 55.)

1. Active members of an occupational retirement fund

The transfer of a portion of a member’s pension interest to a non-member spouse’s chosen fund does not fall within the

ambit of section 14.2

2. Upon resignation of a member of an occupational retirement fund

The benefit may be preserved in the same fund, taken in cash, or transferred to another pension, provident, retirement annuity, pension preservation or provident preservation fund, with no tax payable at the point of transfer.3 The member may also elect to take a portion of the benefit in cash and transfer the balance to a preservation fund. The amount taken in cash will not be regarded as the member’s one-off withdrawal allowed in the preservation fund.4

Section 14 does not apply when a member exits a fund after resignation or retirement, or when beneficiaries purchase annuities following a member’s death.

Since the withdrawal of SARS Practice Note RF 1 of 2012, members are allowed to split their withdrawal benefit by transferring to more than one preservation fund.5

With effect from 1 March 2021, no tax is payable on transfers from pension funds or pension preservation funds to provident funds or provident preservation funds.6

3. Members of a preservation fund and retirement annuity fund

• Preservation funds

A member of a preservation fund may transfer their preservation fund benefit to their new employer’s occupational pension or provident fund, to another preservation fund or to a retirement annuity fund free of tax.7 The transfer is subject to section 14.

• Retirement annuity funds

From a retirement annuity fund to an occupational retirement fund

Such a transfer is not allowed, as members may not transfer from a more restrictive retirement fund to a less restrictive retirement fund tax-wise. In a retirement annuity fund, members are not allowed to access their benefit before at least age 55. If they are allowed to transfer to an occupational retirement fund, those members will be able to access the benefit should they resign from employment. The Income Tax Act does not allow a tax deduction for such transfers either.8

From a retirement annuity fund to another retirement annuity fund

Transfers between retirement annuity funds are allowed.9 Transfers of separate contracts held by the same member in a retirement annuity fund to different retirement annuity funds are allowed with effect from 1 March 2023, provided that the value of the contract(s) being transferred to the other retirement annuity fund is more than R371 250, and if the individual is not transferring all existing contracts, the total value of the remaining contracts must be more than R371 250.

No tax will be payable on the transfer,10 and it is subject to section 14.

Transfers on or after retirement

(In an occupational retirement fund, the period after a member retires from employment. In a preservation fund or retirement annuity fund, the period after the age of 55.)

Read more...

After retirement from employment, a member may preserve the retirement benefit in the same occupational retirement fund if the rules allow for such deferral. When a member elects to start receiving the retirement benefit, the member may take a portion of the retirement benefit in cash and purchase an annuity (pension) with the balance. The portion taken in cash will be taxed in accordance with the retirement tax tables and no tax will be payable on the amount used to provide the annuity.11 The annuity payments will, however, be taxed as income.12

Alternatively, any time after retirement from employment, and if the rules of the member’s fund allow this, the member may choose to transfer the deferred retirement benefit in their occupational retirement fund to:

- a retirement annuity fund (from 1 March 2018);13 or

- a preservation fund (from 1 March 2019).14

No tax will be payable on these transfers,15 and they are not subject to section 14.16

The retired member will not have the option of a one-off withdrawal from the preservation fund and the benefit will only be payable as a retirement benefit when the retired member elects to start receiving the retirement benefit from the preservation fund.17

No cash withdrawal is possible at the time of transfer. In terms of the Income Tax Act, only the full retirement interest (the full fund value on the date that the member elects to transfer from the retirement fund) may be transferred. In the same way, the member may not partially defer their retirement in their occupational retirement fund – only the full amount may be deferred.

After reaching the age of 55, a member of a preservation fund may transfer their retirement benefit to another preservation fund or a retirement annuity fund with no tax being payable.18

Legislation does not allow for a transfer of a retirement benefit after the age of 55 between retirement annuity funds or from a preservation fund to an occupational retirement fund.19

Transferring a deferred retirement member’s benefit in an occupational retirement fund to another occupational retirement fund is not allowed either. The concern with allowing transfers between occupational retirement funds is that the transferor and transferee retirement funds may have different rules with regard to their respective normal retirement ages. This would enable a member to access retirement benefits (as a withdrawal benefit) that were not available in the retirement fund they transferred from. In the 2023 National Budget, it was announced that National Treasury is considering allowing such transfers, provided that a deferred retirement member may only use the benefit as a retirement benefit and may never take it as a withdrawal benefit.20

Transfers of annuities

1. Living annuities

A pensioner in receipt of a living annuity from a retirement fund may, if the rules of the retirement fund allow this, transfer the living annuity to an insurer.21 The liability to pay the annuity passes from the retirement fund to the insurer and, as a result, constitutes a transfer of business from the retirement fund to the insurer, and section 14 of the Pension Funds Act will be applicable.22

Living annuitants may also transfer their annuity between insurers. The Prudential Authority has given standing approval in respect of transfers of living annuity policies between insurers and living annuity policies to conventional or life annuity policies, subject to certain conditions.23

From an insurer to an occupational retirement fund

There is no express provision in the Insurance Act dealing with the transfer of insurance business assets and liabilities from an insurer to a retirement fund. The Prudential Authority intends to propose an amendment to the Insurance Act to clarify any uncertainty in this regard.24

To another retirement fund

In terms of the definition of “living annuity” in the Income Tax Act, members’ living annuities in an occupational retirement fund may be transferred to another occupational retirement fund as part of a group transfer. A fund with in-fund living annuitants will therefore be able to transfer members’ benefits to an umbrella fund, including transferring living annuitants to the umbrella fund.

No tax will be payable on the transfer of a living annuity, but the transfer is subject to section 14 of the Pension Funds Act.

2. Life annuities

Death benefits

A beneficiary who received a death benefit in terms of section 37C, may purchase a pension with the benefit if allowed in the fund rules, in which case the death benefit will be considered not to accrue for tax purposes, so no tax will be payable on the portion used to purchase a pension. No such tax concession is available on transfers to preservation funds or retirement annuity funds, as the death benefit has already accrued in the name of the member.