Find out what benefits you qualify for?

Core Benefits

Retirement Fund

Scheme for Spouse’s Cover

Disability Benefits

Group Life Insurance Scheme

Funeral Cover

Life Stage Model

Join the Pension Fund

Age 53 - optional Portfolio change

Age 60 - retirement planing process

Age 65 - Retirement

What investment options does SURF offer me?

Investment Choice option

From age 53, USRF offers members investment options outside the default investment strategy.

If you opt for the Investment Choice option, from age 53, you may choose to invest your fund credit in these portfolios.

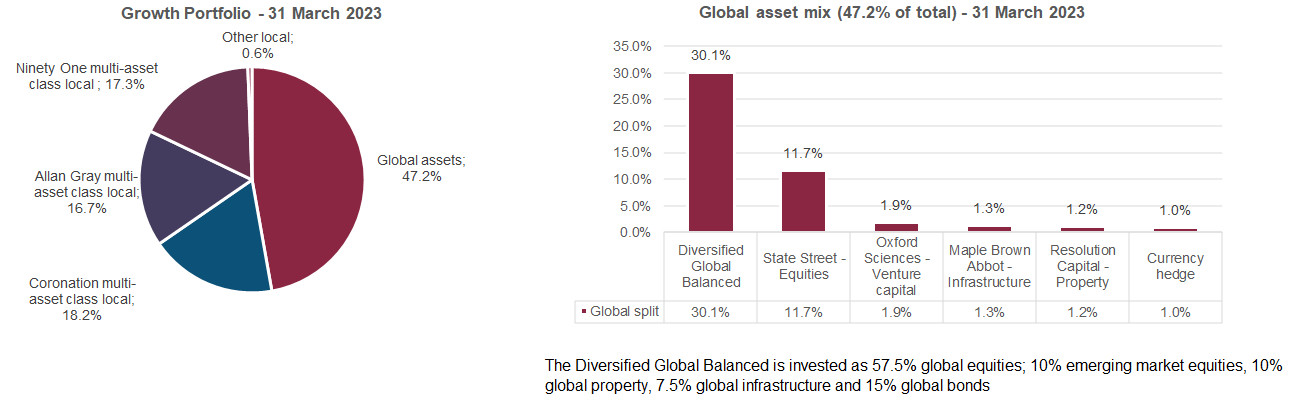

The Growth Portfolio

The Growth Portfolio consists of both a local and an offshore component. The local component is split in equal portions between the following investment managers: Allan Gray, Coronation and Ninety One. It should be noted that differences in investment returns of the managers result in changes in manager allocations from time to time. The offshore component is managed by Willis Towers Watson.

The composition of the Growth Portfolio per manager allocation as at 30 November 2022 was as follows: