About the Fund

About the Stellenbosch University Retirement Fund (“SURF”)

The Stellenbosch University Retirement Fund (“the Fund”) was started in November 1994 and was originally called the Universiteit van Stellenbosch Aftredefonds. The Fund is a Type B umbrella fund since June 2011. In 2020, the name changed to Stellenbosch University Retirement Fund.

The Fund is registered with the Financial Sector Conduct Authority (FSCA) as a defined contribution provident fund. Defined contribution means that the benefit you will receive on retirement depends mainly on the contributions made towards your retirement savings, plus investment return thereon.

The Fund is thus effectively a “savings plan” – established by your employer to help you save for retirement. Every month, your employer pays a percentage of your salary to the Fund on your behalf. All the retirement savings monies will earn investment returns (positive or negative) for you so that you are able to buy a reasonable pension (annuity) one day when you have retired, and you are no longer earning a salary. In addition to providing retirement benefits, the Fund also provides ill-health, death, resignation and retrenchment benefits. Disability and funeral benefits are provided for outside the Fund.

Membership of the Fund

All permanent employees will automatically become members of the Fund on appointment, provided that they are not members of another retirement funding arrangement which the employer participates in. Employees appointed on a fixed term contract with benefits also qualifies for membership.

Active membership ceases when an employee leaves the employ of the employer or when the participating employer’s participation in the Fund ceases. This means that even if you transfer to another division of the University, membership continues until your normal retirement age of 65 years, or any other age agreed to by your employer as reflected in your employment contract. However, if you choose to leave your benefit in the Fund you will become a paid-up member or a deferred retiree and remain a member of the Fund subject to certain conditions.

Members Guide

The University of Stellenbosch Retirement Fund (SURF) offers retirement and death benefits to members and their dependants with the aim to offer them the best benefits available for the contributions paid.

Participating Employers

The following employers participate in the Fund in terms of the rules of the Fund:

- Bureau of WAT

- Unistel Group Holdings Proprietary Limited

- Stellenbosch University

- USB Executive Development Limited

- Stellenbosch University Sport Performance Institute (SUSPI)

- Stellenbosch Institute for Advanced Study (STIAS)

- African Sun Media (ASM)

- Factory 209 (Pty) Ltd (F209)

Who owns the Fund?

The Fund is a separate legal entity. This means that it does not belong to the employer or the administrator.

Registration number

The Fund is registered with the FSCA. The FSCA registration number is 12/8/30965.

Contributions

Contributions

Contributions and benefits are recalculated as from the first day of the month in which your pensionable salary is adjusted.

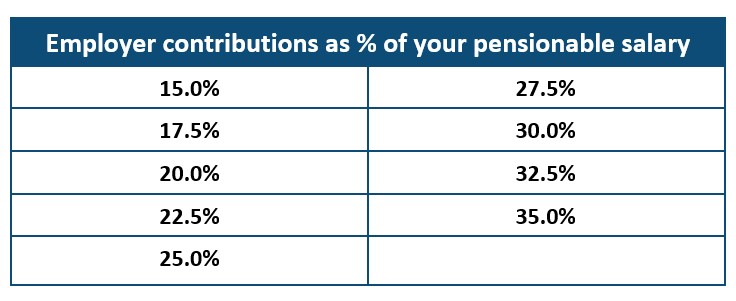

The minimum contribution to the Fund is 15% of pensionable salary. You may however select to contribute up to 35% of pensionable salary.

Once a year you have the opportunity to restructure your remuneration package by selecting one of the contribution categories below:

Investment Strategy

Investment Strategy

UP TO AGE 60 > Invested in the Growth Portfolio

FROM AGE 60 – 65 > in 25 quarterly switches, ending in 50% Aggressive Absolute Return portfolio and 50% Conservative Absolute Return portfolio at age 65

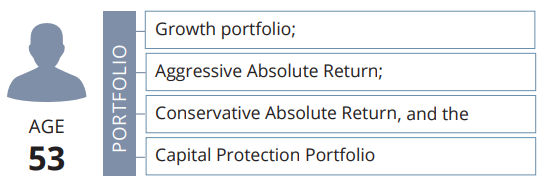

From the age of 53, members can also choose to invest their fund value in the following portfolios:

The Fund also offers a Shari’ah investment portfolio option to members who wish to invest their fund value in accordance with the principles of the Islamic religion.

Retirement Benefits

Retirement Benefits

You must retire by December of the year in which you turn 65, or as stipulated in your employment contract with SU.

You may retire at any point after having turned 55 years, subject to SU’s approval. The value of the early retirement benefit is your SURF fund credit.

Your retirement benefit is the value of your SURF fund credit.

Your SURF fund credit consists of the sum of the following amounts:

- contributions made to the Fund in respect of your retirement benefit;

- additional contributions that you have made to the Fund in respect of your retirement benefit;

- transfers made from other funds;

- the credit amount also increases or decreases according to the investment income.

Upon retirement:

- You may defer your retirement from the SURF i.e. take your retirement benefit at a later stage, if you plan to pursue a second career after your retirement from the University.

- You may take all or a part of your retirement benefit as a cash lump sum and buy an annuity (pension) with the part not taken in cash at that stage.

- You may transfer your retirement benefit to a retirement annuity fund.

Death Benefits Before Retirement

Death Benefits Before Retirement

If you should die before the normal retirement age and while still in SU’s employ, the following benefit is payable:

SURF fund credit

Your full SURF fund credit is payable, minus any costs incurred in order to discover potential beneficiaries. This amount will be paid out to your dependants or beneficiaries (or both) as determined by the SURF trustees.

NB: If you have decided not to opt out of the approved death cover offered by the Fund, the following will also be paid:

Spouse’s pension

The pension payable to your spouse is equal to 35% of your pensionable salary, for life. The pension will increase with inflation, but capped at 10%.

Children’s pension

Pension for children is equal to 10% of your pensionable salary, and is payable for each dependent child but limited to three dependent children at any given moment. Should no pension be payable to a spouse, the amount of the children’s pension will be doubled. The pension will increase with inflation, but capped at 10%.

A ‘dependent child’ is your child – also a legally adopted child and a stepchild – who meets the following criteria: unmarried, under 18 years of age and dependent on you at the time of your death. The trustees may determine that the age restriction be raised from 18 to 25 years in the case of a child who studies fulltime. If the child was completely dependent upon you for medical reasons, the age limit may be dispensed with.

The minimum death benefit payable is twice the amount of your annual pensionable salary.

Termination Benefits

Termination Benefits

In the case of normal resignation, as well as termination of employment due to the abolition of your position, your SURF fund credit is payable.

Your options at termination of employment are:

- You can preserve your fund credit in the Fund.

- You may transfer your fund credit tax free to another approved provident fund, preservation fund or retirement annuity fund.

- You can take the full amount in cash, but tax will be payable.

Disability Benefits

Disability Benefits

If the insurer has declared you medically disabled, you are entitled to a disability benefit under the Disability Scheme after the waiting period has expired.

After twelve months (or as insurer determines) have expired, the Scheme must consider whether you will be able to pursue a similar profession for which you may be declared fit, or for which you may reasonably be expected to receive training – taking into account the degree of your disability as well as your personal knowledge, training and level of education.

PLEASE NOTE: The meaning attached to ‘disability’ is set out in full in the official insurance policy, of which you may request a copy. This guide is only a general summary of the policy benefits. Please consult the policy document itself for the precise formulation of the benefits under the policy. All claims are submitted to the insurer underwriting this Scheme, and the insurer’s decision to approve or reject a specific claim for disability is final.

The Disability Benefit becomes payable after the insurer has declared you medically unfit for work and a waiting period of three months has expired. During the waiting period, SU must continue to pay your full remuneration, provided that you have sufficient leave available.

Your benefit amount will be equal to your monthly pensionable salary (subject to such limitation as the insurer may set). If you want to take out cover that exceeds the Scheme’s proof free limit, you have to provide the insurer with medical proof of insurability before such cover will be extended.